Tesla Stock market today , Recent Stock Performance , Declining Sales in Key Markets, Financial Outlook and Analyst Perspectives , Competitive Pressures ,

Tesla Inc.

(TSLA) has recently experienced significant fluctuations in its stock performance, influenced by a combination of internal challenges and external market dynamics.

Recent Tesla Stock Performance

As of March 5, 2025, Tesla’s stock is trading at $271.05, reflecting a slight decrease of 0.36% from the previous close.

The day’s trading range saw a high of $281.44 and a low of $267.96, with a trading volume of approximately 29.96 million shares.

https://globalindianstory.com/spy-stock-a-comprehensive-analysis/SPY Stock

Declining Tesla Sales in Key Markets

Tesla’s sales have shown a downward trend in several crucial markets:apnews.com+1en.wikipedia.org+1

- Europe: In January 2025, Tesla’s sales in Europe plummeted by 45% year-over-year, even as the overall market for electric vehicles (EVs) in the region expanded.

- markets.businessinsider.com+1reuters.com+1

- China: February 2025 witnessed a significant 49.2% drop in sales of China-made Tesla vehicles compared to the same month in the previous year,

- marking the lowest sales figures since August 2022. markets.businessinsider.com

Impact of Tesla CEO Elon Musk’s Political Engagements

Elon Musk’s active involvement in political matters has raised concerns about potential repercussions on Tesla’s brand and sales:reuters.com+6apnews.com+6marketwatch.com+6

- Political Involvement: Musk’s engagement in right-wing politics has reportedly alienated a segment of Tesla’s traditional customer base,

- particularly those with liberal inclinations, leading to decreased favorability and sales. apnews.com+1ft.com+1

- Public Criticism: Figures like Dave Portnoy, founder of Barstool Sports, have publicly questioned Musk’s focus on Tesla, especially in light of his political endeavors and the company’s declining stock value. nypost.com+1benzinga.com+1

Competitive Pressures

Tesla faces intensifying competition from both established automakers and emerging EV manufacturers:reuters.com+1markets.businessinsider.com+1

- BYD’s Ascendancy: Chinese competitor BYD reported a 90.4% increase in vehicle sales,

- contrasting sharply with Tesla’s declining performance in the same period. markets.businessinsider.com

- Market Share Erosion: In the U.S., Tesla’s share of the new EV market fell to 44% in the fourth quarter of 2024, down from 78% three years earlier, indicating a loss of dominance amid growing competition. reuters.com

Financial Outlook and Analyst Perspectives

Financial analysts have adjusted their outlook on Tesla:benzinga.com+1m.economictimes.com+1

- Goldman Sachs: Analyst Mark Delaney maintained a ‘Neutral’ rating on Tesla but lowered the price target from $345 to $320, citing weaker-than-expected demand, particularly in Europe,

- and anticipating challenging fundamental conditions in the near term. benzinga.com

- BofA Securities: Analysts reduced Tesla’s price target from $490 to $380, expressing concerns over slower growth and rising risks,

- including increased competition and potential brand damage due to Musk’s political activities. marketwatch.com

Internal Developments

Internal actions within Tesla have also attracted attention:reuters.com+1nypost.com+1

Stock Sales by Board Chair: Robyn Denholm, Tesla’s board chair, sold approximately $117 million worth of Tesla stock over a 90-day period amid the stock’s decline,

raising questions about internal confidence in the company’s trajectory. m.economictimes.com

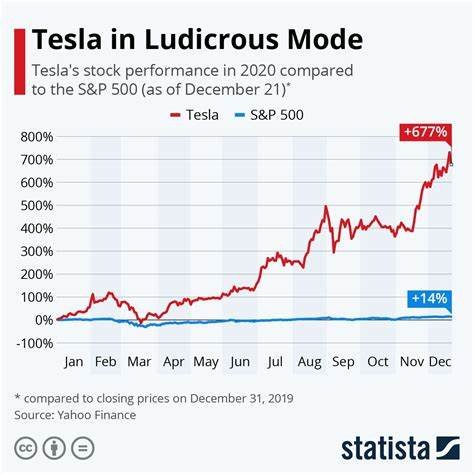

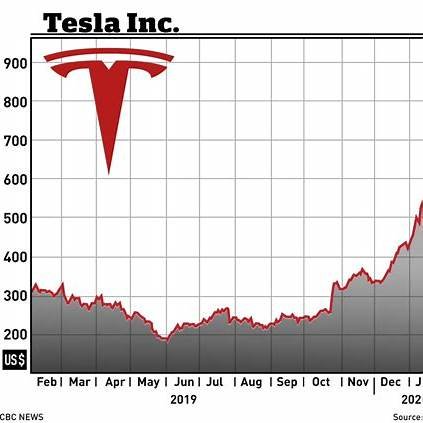

Certainly! Here’s the latest stock chart for Tesla, Inc. (TSLA):

Tesla Inc (TSLA)

$271.05

-$0.99(-0.36%)Today1D5D1M6MYTD1Y5Ymax

Key Metrics

Open272.78

Day Range267.96 – 281.44

52 Week Range138.80 – 488.54

Volume30M

This chart provides a visual representation of Tesla’s recent stock performance, reflecting the latest price movements and trading volumes.

For a more detailed and interactive experience, you can explore Tesla’s stock chart on platforms like TradingView or Yahoo Finance, where you can analyze various timeframes and technical indicators to gain deeper insights into the stock’s behavior.

Please note that stock prices are subject to continuous fluctuations due to market dynamics, and it’s essential to consult real-time data and professional financial advice before making any investment decisions.

1. What is the current price of Tesla stock?

As of today, Tesla’s stock price is $271.05, but stock prices fluctuate frequently due to market conditions. It’s best to check real-time data on platforms like Yahoo Finance, TradingView, or Google Finance.

2. Why is Tesla’s stock falling?

Tesla’s stock has been experiencing a decline due to several reasons:

Elon Musk’s political controversies, which may be impacting the brand image

Declining sales in key markets like China and Europe.

Increased competition from companies like BYD.

Macroeconomic factors like high interest rates affecting EV demand.

3. How do Elon Musk’s actions affect Tesla stock?

Elon Musk’s political involvement and public statements have influenced Tesla’s brand perception, leading some investors and customers to reconsider their stance. His focus on Twitter (now X) and SpaceX has also raised concerns among Tesla shareholders.

1 thought on “Tesla Stock market today”